contact us

Total Pageviews

Facebook Badge

Popular Posts

-

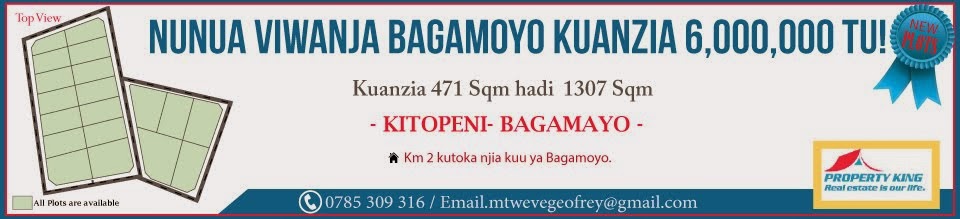

Bagamoyo plots are located 800 meters from kaole university of agriculture and its also near to the indian ocean of a distance of 850 meters...

-

Free land offers to the National Housing Corporation (NHC) by town and municipal councils will only reduce construction costs borne by the ...

-

plots are located 2.5 km from morogoro main road the locality is well built with all the basic social services available.

-

Many excited real estate investors think they can get rich by using a bank loan to purchase and upgrade local fixer-uppers. While investme...

-

10 plots for sale at kibamba njia panda ya shule 2.5 km from main road (morogoro road) with good locality and all social services are a...

-

Global Real Estate Firm Opens In Tanzania Saturday, 26 July 2014 Real Estate Maximum (...

-

location:mwananyamala chai street near mwinyijuma road A single storey 2 bedroom(1 master bedroom), kitchen, livingroom,water reserve w...

-

Owning a home is a cherished dream of many individuals. With owning a home come joy, stability and a sense of accomplishment. Because ...

-

RENTING for office space in the city centre of Dar es Salaam has currently become a nightmare despite of the current high rates introduced f...

Friday, August 22, 2014

KIBAMBA RESIDENTIAL PLOTS ON SALE

plots are located 2.5 km from morogoro main road the locality is well built with all the basic social services available.

Tuesday, August 19, 2014

‘Free land offers won’t make NHC house affordable to all’

Free land offers to the National Housing Corporation (NHC) by town and municipal councils will only reduce construction costs borne by the firm by 20percent.

Even though this would not assure customers of affordable houses as most of the structures would sell at between 28m/-and 30m/-

Speaking to the Guardian in an exclusive interview in Dar es Salaam yesterday, NHC Director of Business Development, David Shambwe explained that the free plots of land will reduce construction cost by 20 percent.

“Once we are able to acquire the land from municipal councils we will be able to cut down construction cost by 20 percent… for that matter, prices of the houses are also expected to plummet,’’ he said.

According to Shambwe, currently prices of NHC house range between 34m/- and 50m/- which he said could drop to between 28m/- and 30m/-.

He said with a positive response from the municipal councils, the Corporation will be able to build affordable house for various groups of people including teachers, health workers and ordinary citizens

Shambwe explained that buyers are allowed to pay in installments but at first the buyers is required to deposit 10 percent of the total value of the house in one of the banks that works with NHC under the mortgage system while the remaining amount is to be paid over a period of between 15 and 20 years.

He further advised municipal authorities to purchase the houses for their workers.

President Jakaya Kikwete made a directive to town and municipal council to allocate plots of land the National Housing Corporation (NHC) under the mortgage system while the remaining amount is to be period of between 15 and 20 years.

He further advised municipal authorities to purchase the house for their workers. President Jakaya Kikwete made a directive to town and municipal councils to allocate plots of land for the National Housing Corporation (NHC) to enable the state firm to build affordable houses for Tanzanians during his official visit to Tanga Region last week

Meanwhile, Alphonse Mwakangale, a Dar es salaam resident appealed to NHC to further reduce the price of the houses to enable low income earners to afford them.

He said 30m/- is still too expensive, “the least I can afford is to purchase a house sold between 10m/- and 15m/-’’ A primary school teacher, Rehema Mubarak recommended NHC for doing a good job but said the price is too high for ordinary citizens hence very few people can afford the house.

“When a house is built by NHC we are sure of its quality and the idea of selling the house to ordinary citizens is great but most of us with low salaries cannot afford them” he said.

According to President Kikwete, construction of the affordable houses is expected to give proper settlements to many people and adorn the municipal councils.

In October last year, NHC officially launched the sale of its 496 low cost houses under a project dubbed ‘My House-My House My Life’ in 11 regions.

The houses were sold at a cost of between 36m/- and 41m/-(VAT executed) and between 43m/- and 49m/- (VAT included)

The houses are in Movomero |(Morogoro), Mkinga (Tanga), Mtanda (Lindi) Mkuzo (Ruvuma), Bombambili (Geita), Mlole (Kigoma), Ilembo (Katavi), Kongwa (Dodoma), Unyankumi (Singida),Mrara (Manyara)and Kibada(Dar es salaam).

Tuesday, August 5, 2014

MAKING MONEY THROUGH RESIDENTIAL REAL ESTATE

Many excited real estate investors think they can get rich by using a

bank loan to purchase and upgrade local fixer-uppers. While investment

opportunities in real estate may be better than alternatives like the

more homogeneous stock market because the existence of small, local real

estate markets that create inefficiencies investors can exploit, you'll

need to understand more than this to make money in residential real

estate. To go from handyman to real estate tycoon, you must understand

the market and the three key ingredients to strong real estate gains.

Look for a Healthy National Market

While experienced and astute real estate investors may be able to make some money in a weak national real estate environment, the odds are against them, and the odds of success for newer investors in such a market are even worse. Rising interest rates can throw a lot of cold water on an otherwise hot real estate market because those who have purchased real estate with adjustable rate mortgages have to pay more to keep it and those who don't have real estate often can't afford it. This leads to reduced demand for real estate, and prices fall accordingly.

Thus, when starting to build your real estate portfolio, the ideal time is in a declining interest rate environment. Generally speaking, not only will your loan be less expensive, but demand is likely to be higher, barring a momentary credit crunch, which can be withstood by good capital management.

Another desirable trait is a healthy gross domestic product (GDP), since this figure really speaks to the overall health of the economic system that supports the real estate market. In healthy GDP times, such as growth above 3% annually, it is rare to see significant real estate weaknesses.

Lastly, unemployment-rate data is often the best leading indicator of market softness. If people see few prospects for income around where they live, they move. In turn, this greatly reduces home price appreciation (HPA).

Choose a Specific Location

If you find flat to falling interest rates, decent GDP growth and respectable unemployment rates in the national market, you can start looking for a desirable local market. Seek out an area with relatively strong appreciation potential relative to other markets. Well-publicized data like the Case-Shiller Home Price Index and Bureau of Labor Statistics unemployment rates are excellent indicators into the future health of the top real estate markets.

Local unemployment data is often a leading indicator to the housing data. The smart investor looks to invest in a city that is exhibiting healthy unemployment trends and relatively strong HPA data. Hopefully, this is a city where you live and therefore have a strong grasp of the vagaries of the local marketplace and can easily manage the property. However, with sound management controls, it can be possible to invest successfully in other locations where quality management partners are available.

Find the Urban Sprawl Inflection Point

Once you have found the ideal city for your desired investment, look for the urban sprawl hotspot. If you see the city expanding and can tolerate some risk, invest in real estate in the outer perimeter. However, if the market looks ominous or vague, stick to the inner rings so that you have a buffer against reverse urban sprawl. Warning signs to stay away from the perimeter include: material unemployment changes and/or slowing economic growth in the local area. Or simply look at the underlying business health of the major employers in the area. If it is weak, layoffs are likely coming, which could start to suppress real estate values due to marginal labor supply attrition. If the business health of the area's major employers is strong, the opposite is true.

Real estate values can vary widely within a metropolitan area. For example, if the average HPA in a city is 5%, it may be 2% downtown, 6% in the first suburban ring and 10% in the second suburban ring. The third ring would likely be farmland with modest HPA potential. Note the phenomenon here. Your most volatile real estate appreciation will happen in the outer ring adjacent to the farmland because this is the outer cusp of the city. This location leverage is exploitable by owning the edge in growth markets. Logically, in a down market, you would want to be in the core. This is where the least depreciation is likely to occur since full housing markets make this the least likely place for supply and demand balance disruption.

Understanding investing risk in different areas of the city is very similar to understanding how financial instruments generally behave. Think of the urban area of a city as investment-grade bonds, the first suburban ring as equities, and the outer ring as derivatives. Understanding where the urban sprawl inflection is occurring in a city can bolster returns on the upside, or protect investment on the downside.

For fun, let us peel the onion one more layer to find the hottest areas. Suppose that you decide to invest in the perimeter since you see economic growth and growing labor demand in the area. You could try to anticipate stoplight location. That is where future commercial properties like suburban strip malls will be built, and as residential real estate development fills in around these future strip malls, property values will likely jump significantly relative to average real estate returns.

Conclusion

The opportunity for above-average rates of return seems greater in the real estate realm than the financial instrument realm since because are fewer eyes looking at nonhomogenous units. In addition, knowing the local market produces investment advantage. A long-term or buy-and-hold strategy is better if you have ample capital and limited opportunities, while a short-term or flipping strategy would make more sense if you have tremendous insight into the sweet spots and limited capital. Regardless of your time frame, you should first look for a strong national market, then a region where publicized data shows decent HPA opportunity, and finally, play the urban sprawl perimeter if you believe the area is growing, or stay away from it if you think it is shrinking. Understanding these key points can help maximize value of any real estate portfolio.

Look for a Healthy National Market

While experienced and astute real estate investors may be able to make some money in a weak national real estate environment, the odds are against them, and the odds of success for newer investors in such a market are even worse. Rising interest rates can throw a lot of cold water on an otherwise hot real estate market because those who have purchased real estate with adjustable rate mortgages have to pay more to keep it and those who don't have real estate often can't afford it. This leads to reduced demand for real estate, and prices fall accordingly.

Thus, when starting to build your real estate portfolio, the ideal time is in a declining interest rate environment. Generally speaking, not only will your loan be less expensive, but demand is likely to be higher, barring a momentary credit crunch, which can be withstood by good capital management.

Another desirable trait is a healthy gross domestic product (GDP), since this figure really speaks to the overall health of the economic system that supports the real estate market. In healthy GDP times, such as growth above 3% annually, it is rare to see significant real estate weaknesses.

Lastly, unemployment-rate data is often the best leading indicator of market softness. If people see few prospects for income around where they live, they move. In turn, this greatly reduces home price appreciation (HPA).

Choose a Specific Location

If you find flat to falling interest rates, decent GDP growth and respectable unemployment rates in the national market, you can start looking for a desirable local market. Seek out an area with relatively strong appreciation potential relative to other markets. Well-publicized data like the Case-Shiller Home Price Index and Bureau of Labor Statistics unemployment rates are excellent indicators into the future health of the top real estate markets.

Local unemployment data is often a leading indicator to the housing data. The smart investor looks to invest in a city that is exhibiting healthy unemployment trends and relatively strong HPA data. Hopefully, this is a city where you live and therefore have a strong grasp of the vagaries of the local marketplace and can easily manage the property. However, with sound management controls, it can be possible to invest successfully in other locations where quality management partners are available.

Find the Urban Sprawl Inflection Point

Once you have found the ideal city for your desired investment, look for the urban sprawl hotspot. If you see the city expanding and can tolerate some risk, invest in real estate in the outer perimeter. However, if the market looks ominous or vague, stick to the inner rings so that you have a buffer against reverse urban sprawl. Warning signs to stay away from the perimeter include: material unemployment changes and/or slowing economic growth in the local area. Or simply look at the underlying business health of the major employers in the area. If it is weak, layoffs are likely coming, which could start to suppress real estate values due to marginal labor supply attrition. If the business health of the area's major employers is strong, the opposite is true.

Real estate values can vary widely within a metropolitan area. For example, if the average HPA in a city is 5%, it may be 2% downtown, 6% in the first suburban ring and 10% in the second suburban ring. The third ring would likely be farmland with modest HPA potential. Note the phenomenon here. Your most volatile real estate appreciation will happen in the outer ring adjacent to the farmland because this is the outer cusp of the city. This location leverage is exploitable by owning the edge in growth markets. Logically, in a down market, you would want to be in the core. This is where the least depreciation is likely to occur since full housing markets make this the least likely place for supply and demand balance disruption.

Understanding investing risk in different areas of the city is very similar to understanding how financial instruments generally behave. Think of the urban area of a city as investment-grade bonds, the first suburban ring as equities, and the outer ring as derivatives. Understanding where the urban sprawl inflection is occurring in a city can bolster returns on the upside, or protect investment on the downside.

For fun, let us peel the onion one more layer to find the hottest areas. Suppose that you decide to invest in the perimeter since you see economic growth and growing labor demand in the area. You could try to anticipate stoplight location. That is where future commercial properties like suburban strip malls will be built, and as residential real estate development fills in around these future strip malls, property values will likely jump significantly relative to average real estate returns.

Conclusion

The opportunity for above-average rates of return seems greater in the real estate realm than the financial instrument realm since because are fewer eyes looking at nonhomogenous units. In addition, knowing the local market produces investment advantage. A long-term or buy-and-hold strategy is better if you have ample capital and limited opportunities, while a short-term or flipping strategy would make more sense if you have tremendous insight into the sweet spots and limited capital. Regardless of your time frame, you should first look for a strong national market, then a region where publicized data shows decent HPA opportunity, and finally, play the urban sprawl perimeter if you believe the area is growing, or stay away from it if you think it is shrinking. Understanding these key points can help maximize value of any real estate portfolio.

GLOBAL REALESTATE FIRM IN TANZANIA...!!

| Global Real Estate Firm Opens In Tanzania |

|

|

| Saturday, 26 July 2014 |

Real Estate Maximum (RE/MAX), a

US-based firm, has established a presence in the Tanzania real estate

market, which, according to RE/MAX stakeholders, will help to improve

how the industry operates within the country. According

to Dr. Ovunc Aslan, the East African Chairman of RE/MAX, they currently

plan to establish more than 100 offices across the country, which will

address the growing demand and bring new improvements to the industry. According

to Dr. Ovunc Aslan, the East African Chairman of RE/MAX, they currently

plan to establish more than 100 offices across the country, which will

address the growing demand and bring new improvements to the industry."With several years of operating the real estate industry in other parts of the world we have a largest network, enough experience and modern training system, which we will use in improving the industry in Tanzania,” he said, “The country's population is growing faster and as it grows the demand for housing increases, thus there is the need to have a strong real estate industry that will accommodate the fastest growing population.” With more than 40 years of experience on an international level and with operations in more than 90 countries, RE/MAX is the world's largest network of real estate brokers |

DID YOU KNOW THAT BANK OF AFRICA IS BANK IN TANZANIA WHICH ISSUES LOWEST RATE FOR HOME LOANS WITH LONGEST REPAYMENT PERIOD....!!!

Owning a home is a cherished dream of many individuals. With owning a home come joy, stability and a sense of accomplishment.

Because we at Azania Bank know the contentment home owning brings to you, and because we would like to be a part of your accomplishments and share your joy.

We welcome you to realize your dream, because it makes sense! The minimum requirements for this

For more details, click here to download the brochure

HOUSE LOAN PAYMENT SCHEDULE @ 18% p.a or 1.5% monthly

(i) HOUSE PURCHASE (Tshs. 000)

(ii)HOUSE CONSTRUCTION (Tshs. 000)

Because we at Azania Bank know the contentment home owning brings to you, and because we would like to be a part of your accomplishments and share your joy.

We welcome you to realize your dream, because it makes sense! The minimum requirements for this

- A savings account with Azania Bank amounting to 20% of the expected loan.

- A title deed of the property.

- The sale agreement if you are buying a house.

For more details, click here to download the brochure

HOUSE LOAN PAYMENT SCHEDULE @ 18% p.a or 1.5% monthly

(i) HOUSE PURCHASE (Tshs. 000)

| NO. of years | 5000 | 10,000 | 20,000 | 30,000 | 40,000 | 50,000 |

| 1 | 451 | 903 | 1,805 | 2,708 | 3,610 | 4,513 |

| 2 | 242 | 485 | 970 | 1,455 | 1,939 | 2,424 |

| 3 | 173 | 347 | 693 | 1,040 | 1,387 | 1,733 |

| 4 | 139 | 278 | 557 | 835 | 1,113 | 1,392 |

| 5 | 119 | 238 | 476 | 714 | 952 | 1,189 |

| 6 | 106 | 211 | 423 | 634 | 846 | 1,057 |

| 7 | 96 | 193 | 386 | 579 | 772 | 965 |

| 8 | 90 | 179 | 359 | 538 | 718 | 897 |

| 9 | 85 | 169 | 338 | 508 | 677 | 846 |

| 10 | 81 | 161 | 323 | 484 | 645 | 807 |

(ii)HOUSE CONSTRUCTION (Tshs. 000)

| Grace Period | 5000 | 10,000 | 20,000 | 30,000 | 40,000 | 50,000 |

| Month 1 | 63 | 125 | 250 | 375 | 500 | 625 |

| Month 2 | 63 | 125 | 250 | 375 | 500 | 625 |

| Month 3 | 63 | 125 | 250 | 375 | 500 | 625 |

| Month 4 | 63 | 125 | 250 | 375 | 500 | 625 |

| Month 5 | 63 | 125 | 250 | 375 | 500 | 625 |

| Month 6 | 63 | 125 | 250 | 375 | 500 | 625 |

| NO. of years | 5000 | 10,000 | 20,000 | 30,000 | 40,000 | 50,000 |

| 1 | 451 | 903 | 1,805 | 2,708 | 3,610 | 4,513 |

| 2 | 242 | 485 | 970 | 1,455 | 1,939 | 2,424 |

| 3 | 173 | 347 | 693 | 1,040 | 1,387 | 1,733 |

| 4 | 139 | 278 | 557 | 835 | 1,113 | 1,392 |

| 5 | 119 | 238 | 476 | 714 | 952 | 1,189 |

| 6 | 106 | 211 | 423 | 634 | 846 | 1,057 |

| 7 | 96 | 193 | 386 | 579 | 772 | 965 |

| 8 | 90 | 179 | 359 | 538 | 718 | 897 |

| 9 | 85 | 169 | 338 | 508 | 677 | 846 |

| 10 | 81 | 161 | 323 | 484 | 645 | 807 |

Monday, August 4, 2014

PLOTS FOR SALE @ KIBAMBA

10 plots for sale at kibamba njia panda ya shule 2.5 km from main road (morogoro road) with good locality and all social services are available. please contact this number 0714396661 or 0654375765 for more information

Subscribe to:

Posts (Atom)